Neobanks have received significant attention but also massive investments from venture capital firms. Neobanks globally raised more than $12 Billion in 2021, despite the global economic slowdown due to Covid 19. Funding of this scale is not limited to geographical

boundaries. The number of digital-only banks has risen from 250 in 2020 to 333 in 2021.

One cannot help but wonder what is in store for the future of neobanks. How are they going to evolve? But before that, we should understand what pushed neobanks to grow at such an astronomical rate and the global trends that will carve the future of neobanks.

The Rise of Neobanks

The whole BFSI industry and the world have undergone a faster transformation in the last two years than in the previous decades combined, and most likely, will continue to do so in the future. Covid 19 presented immense opportunities to the Finance/BFSI

industry during the turmoil. The last two years of the pandemic undoubtedly forced people to stay indoors and asked banks and financial institutions to rethink their modus operandi.

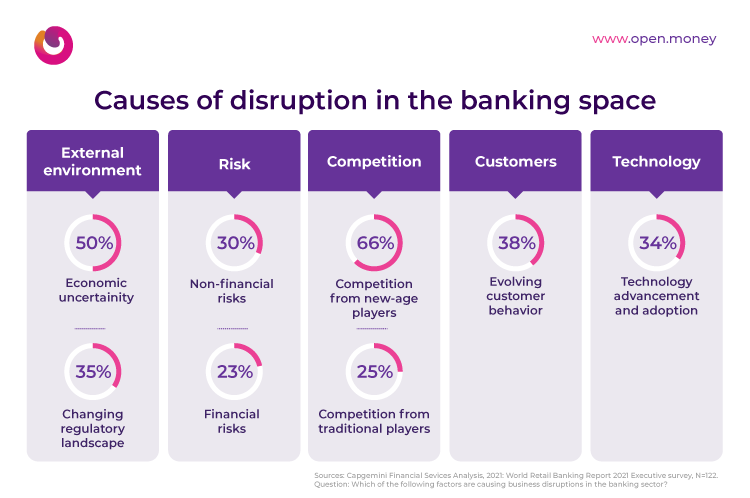

Economic uncertainties, increased competition from digital-only banks, rapidly changing customer requirements, and fast-developing technology completely changed the banking ecosystem, forcing traditional banks to reprioritize their long-term vs. short-term

goals. However, what underpins a conventional bank becomes part of the resistance to required transformations, such as – high operating costs, the burden of back-office operations, limiting banking processes, resistance to change old ideologies, and outdated

systems.

“Pandemic fallout has made the traditional retail banking environment even more demanding. For incumbents to remain relevant, now is the time to embed finance within customer lifestyle and embrace platform-based models — procrastination is no longer an

option.” – John Berry, CEO of the European Financial Management Association (EFMA) in World Fintech Report 2021.

Neobanks – a new hope in turbulent times

The 2008 recession gave birth to a new brand of banks driven by technology. The year 2009 saw Aldermore, the first bank of this kind. These banks moved from brick and mortar to digital-only (fintech with a banking license and providing banking services over

the internet) or challenger banks.

By 2010, a new crop of fintech came up; they called themselves the Neobanks. They focused mainly on the underserved population and provided banking through licenses from conventional banks.

Irrespective of all the developments, it was business as usual for traditional banks till things started going awry when the pandemic hit the world in 2019. They had to digitize their products and services in the shortest possible time. It led the conventional

banks to launch or improve the services of their pre-existing digital-only subsidiaries.

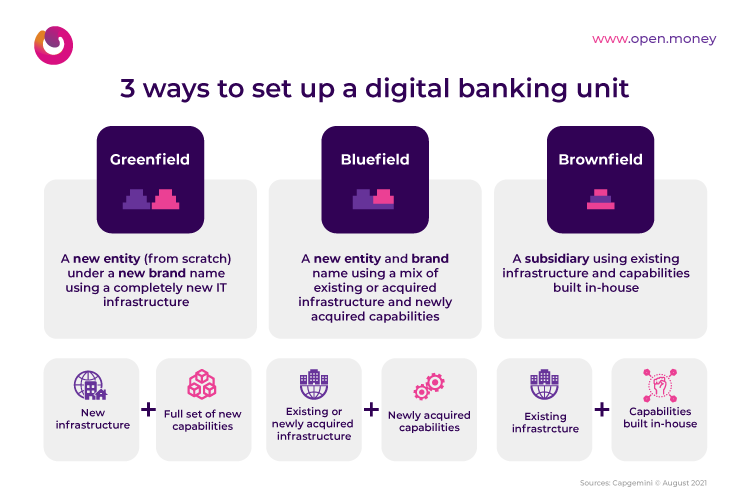

When you look at the above situation, there are three ways to create a digital bank. They are:

- Greenfield: A completely new entity with a new infrastructure and a banking license offering innovative products and services is called Challenger Banks.

- Bluefield: A new entity using a mix of new and acquired infrastructure offering a blend of products and services. They are more likely to leverage the banking license of a traditional bank. They became the Neobanks.

- Brownfield: A traditional bank subsidiary leveraging its resources to deliver products and services to its customers digitally. They became the digital subsidiary of conventional banks and are essentially digital spin-offs of traditional

banks.

”Neobanks are financial technology solution providers capable of providing a suite of banking solutions to a highly targeted niche. They offer banking services in partnership with an established traditional bank.”

Thus, traditional banks had to dig deep to digitize their products and services quickly. While they tried to rise to the opportunity, there was a considerable gap in the market up for grabs for the third parties to enter this space.

The Opportunity

Many traditional banks lacked the expertise to convert most of their offline services to digital. It tied down traditional banks from transforming with their inflexible underpinnings. Customers began to incline towards fintech solutions. With these, customers

could integrate their bank accounts and perform all the banking functions in one place.

“42% of bank executives polled said that they were unsure about how to integrate and streamline office functions effectively from back to front, and 46% said they are unsure how to embrace open banking, orchestrate the ecosystem or become a truly data-driven

organization.” – World Banking Report 2021

Many customers switched to neobanks as they felt traditional banks could have done better given the immense resources available at their beck and call. The gap between the services offered by conventional banks and what customers expected out of them widened.

The disparity between banks and customers became more evident during the pandemic.

Neobanks such as Chime, Open, and Affirm offer innovative solutions with the help of their partner banks. Partner banks such as Celtic Bank, ICICI Bank, and Green Dot Bank lead the pack in working with neobanks to deliver banking solutions.

The Growth

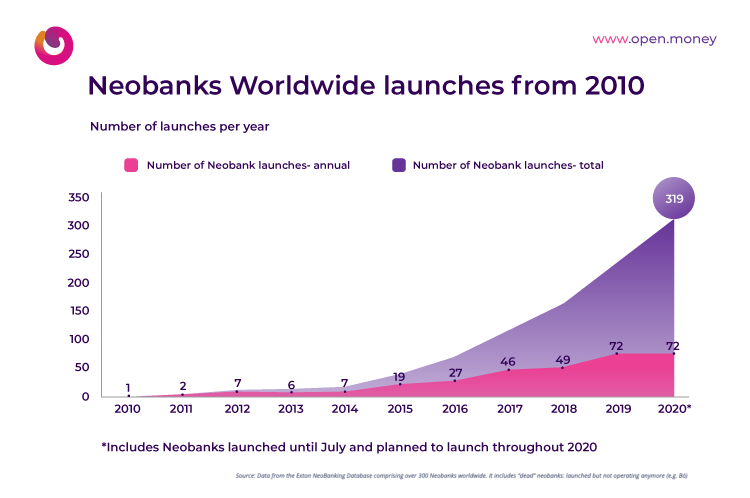

Neobanks have seen immense growth in the past two years. In 2019 there were close to 250 neobanks globally. However, by 2021 the numbers have crossed 333 according to the neobank tracker from The

Financial Brand.

The reason for this astronomical rise of the neobanks is the vast opportunity of the underserved left by traditional banks that were up for grabs during the pandemic. Most of these were freelancers, gig workers, and independent creators.

For example, if you take the US, the gig workforce makes up 35% of the US workforce,

i.e., 60 million gig workers and freelancers. They have seen a 700% increase in transactional value since the pandemic’s beginning, according to a report from

Upwork. Rising inclination towards gig work and increase in transactions from the gig economy makes it a lucrative target market for the neobanks. Many already cater to them, e.g., Open, Lance, Lili, and Novo, target freelancers and gig workers.

In 2020, the valuation of the global neobanking market was at $34.77 Billion. According to grand view research, the neobanking

market expects to expand at a compound annual growth rate (CAGR) of 47.7% from 2021 to 2028. By 2028, the estimated market size of the neobanks will be $722.60 Billion.

Source: Exton Consultancy

Source: Exton Consultancy

ABI Research predicts that the top 57 neo and challenger banks worldwide could potentially jump from

155 million customers in 2020 to 590.6 million in 2026. Neobanks will continue their growth spurt. They will continue to evolve while setting up new trends to carve their future.

Current trends across major markets

Neobanking is going through a massive transformation. Developed markets such as Europe, the US, and the UK are going through regulatory changes that create a favorable environment for the neobanks. New players are now targeting ultra-niche segments of the

market, such as artisans and teenagers. Neobanks are adopting leading-edge technologies, thus nudging traditional banks to reinvent themselves to serve the customers better and increase customer retention.

We will look into each of the above trends in-depth and later explore the future of the neobanks.

Regulatory Changes

Neobanks take the same risks, have unique product offerings, and follow similar processes as traditional banks, so regulators enforce identical rules on neobanks. However, the modus operandi of neobanks is different from the conventional banks. Neobanks

are more digitally inclined than traditional banks. Ideally, the rules that apply to traditional banks need not apply entirely to the neobanks.

Therefore, many regulators across the globe are coming up with newer regulations to support the new breed of banks or neobanks. The USA is coming up with new

regulatory frameworks for banks which are still in discussion. In the initial meetings, we observed that the regulators are focused on understanding various partnerships between banks and fintech. It is likely that in subsequent revisions, they will shift

the focus to neobanks.

The FCA’s regulatory sandbox in the UK that started 7-8 years ago also works with digital banks. In August 2021, the regulatory sandbox from FCA moved to always open, allowing neobanks to submit their applications throughout the year. Neobanks can now access

the testing environment and services of the regulatory sandbox at the beginning of their development lifecycle to maximize the benefits of live market testing for progressing their innovative models.

Similarly, the NITI Ayog in India has recently recommended a similar

approach for digital business banking. The participating fintech solution providers will be given a restricted Digital Bank license and operate as a Digital Business Bank in the sandbox. They will be monitored on matrices such as customer acquisition cost

(CAC), volume and velocity of credit disbursed to MSMEs, technological capability, level of compliance, etc. The sandbox restrictions will be relaxed progressively based on their performance, and the licensee will be given a Full Stack Digital Bank license.

New entrants

The neobanking industry is seeing new players every day. Most of them are creating a micro-niche such as Nerve, a new neobank

that aims to serve the unique needs of professional musicians. Verizon is entering the neobanking space with an offering specifically for kids

and youth called “Family Money,” much like another network operator competitor T-Mobile.

What are the global neobanking players up to?

Top neobanks across the globe are constantly making news. 2020-21 has been a year of M&As and exploring markets.

India seems to hold a high market potential for foreign neobanks due to the market’s sheer scale. Revolut and Tide are starting their operations with their state-of-the-art payment solution for freelancers. Stripe acquired Recko for its payment tracking

and automation. Zip has made a $50 Million Investment in an Indian neobank. Open, Asia’s first neobank, has received Google and Temasek funding.

According to CB Insights, the number of neobank deals (65) declined by 12% from Q4’20 to Q1’21, but funding soared by 25%. It was the first time deal activity fell since Q4’19.

What will impact the future of Neobanks?

The trends that we saw earlier showcase the bright future that the neobanks have ahead of them. Undoubtedly, neobanks will evolve to a point where they can be seen as an alternative to traditional banks. However, one cannot deny that neobanks will be those

partners of conventional banks that will profit from serving the underserved.

Elevated customer experience will be the key differentiator

One thing that is clear after seeing the growth of neobanks is that customers are ready to experiment with their banking service provider. Customers choosing fintech over traditional banks are looking for a better customer experience. Moreover, according

to research by Alan Mclyntre, Senior Industry Director at Accenture, neobanks have been more receptive and empathetic than

conventional banks during the pandemic.

Additionally, advancements in technology have only brought banking services closer to customers. Neobanks have been continuously striving to provide better banking services digitally to earn their customers’ trust. Physical interaction with customers is

not the only way to build trust; providing the right CX digitally also goes a long way.

Embedded Finance and future of the neobanks

When we talk about the future of the neobanks, it isn’t complete without discussing embedded finance and the kind of key it holds to the future. Embedded finance is a fintech model where brands can leverage APIs to integrate banking and financial features

into their apps and ecosystem.

It opens new opportunities for fintech and brands. They can add financial services to their existing product portfolio. The embedded finance players can lease licenses and access specific banking stacks to fintech and brands. It reduces compliance and development

costs, thus enabling the neobanks to create more customer-specific solutions.

Embedded financial services have redefined speed, seamless integration, and an intuitive flow by eliminating intrusions in a platform’s customer journey. Moreover, the essential characteristics of these services are credit affordability and customized, in-context

financial offerings. The recent EY study states that 63% of people would ‘highly value’ open

banking and embedded finance solutions to create personalized experiences due to ease of use.

For example, suppose an eCommerce brand is integrated with an embedded finance solution. Generally, customers research products they wish to buy, make a list, and end up buying a small fraction of products from that list due to budget constraints. By analyzing

the purchase pattern, transaction messages, and many other factors, the brand decides the customer’s creditworthiness and extends a small loan or a buy now pay later (BNPL) offer to the customer. The customer will most likely buy most of the products on the

list.

The above example is only the tip of the iceberg of what brands can achieve with embedded finance. There can be millions of use cases based on the brand, what they sell, who their customers are, and what the customer journey looks like. This story also holds

for SMEs.

Moreover, SMEs are more in tune with embedded banking than anybody else. According to a recent study by Accenture, 41% of SMEs are

interested in receiving banking services from digital platforms and prefer performing all financial activities on the same platform without switching through multiple apps. 47% of them are willing to pay a premium to avail themselves of the embedded banking

services on the digital platform. It is an excellent time for the digital platforms offering embedded banking services. It is also worth noting that the embedded finance market for SMEs will be worth $125 billion by 2025.

Brands such as Walmart and Ikea are already making their move. Walmart recently announced that it is building a financial-services

offering with their financial technology investor Ribbit. Ikea announced that it is purchasing 49 percent of

its banking partner. These are some of the many decisive moves large brands take to embed financial services into their existing portfolio of products. More brands in B2B and B2C categories will follow suit to deliver a seamless customer experience and

offer a complete customer journey on a single platform.

Conclusion

The number of choices customers will have for choosing a banking solution for themselves will be huge in the future. And these options will only keep on increasing. While it might seem like traditional banks are struggling to keep up with neobanks, that’s

not the case. Neobanks will be leveraging their partnerships with the banks to offer banking services to new niches. The coming years will see an influx of new innovative neobanks targeting particular target segments.