The USD 200 trillion B2B payments flow is rapidly moving towards a ‘checkout’ experience similar to B2C payments. For banks, the resulting digital data footprint is unlocking a USD 13 trillion revenue opportunity in SME lending.

The case for digitising the B2B payments flow is a well-established one by now. Expected to exceed USD 200 trillion in volumes by 2028, B2B payments are seeing focused efforts to solve deeply entrenched inefficiencies like manual processing, high costs,

limited transaction visibility and payment delays. As businesses increase their use of electronic payments, fintech innovation is taking B2B payments towards a ‘checkout’ experience similar to B2C payments, with focus on automated, fast and frictionless transactions

for the buyer and seller.

Players like payments service providers, card networks, merchant platforms and financial automation providers are digitising different parts of the value chain, addressing accounts payable - accounts receivables (AP-AR) automation, cash flow management,

integration of payments into ERP systems and more. The coming together of these solutions into a cohesive B2B payments experience is especially relevant for small and medium enterprises (SMEs) as it can unlock value for them in three significant ways:

-

Access to financial automation features that can cut costs by 75% and unlock USD 1.5 trillion in productivity benefits

-

Ability to accept payouts in a variety of payment modes, increasing their chances of being paid faster and with less friction

-

Access credit and liquidity management solutions embedded in the payments flow, addressing the longstanding working capital credit gap

The third aspect, embedding of credit at B2B point of sale (POS), especially for the mid-market segment, has been seeing a lot of traction. Fintechs focused on solving B2B payments have made steady progress over the past few years, using transactional data

and alternative risk-assessment to deliver transaction or PoS-based lending to underserved SMEs.

The global commercial lending market is expected to grow at over 15% CAGR, yielding up to USD 27 trillion between 2021 to 2028. SMEs will account for USD 13 trillion of the revenues. For banks, B2B POS-based lending offers a low-risk approach to scale SME

lending while capturing the mid-market commercial lending segment.

What is B2B POS-based Lending?

Apart from asset-backed or secured lending products, banks issue unsecured working capital credit in the form of credit lines or corporate credit cards. These loans are issued based on assessment of traditional business data around profitability, balance

sheet and credit history. This precludes credit access to businesses that are new to credit, thin-filed, or not yet profitable despite having steady revenues.

With B2B POS-based lending, banks can embed financing options like buy now pay later (BNPL), or early/instant settlement at the point of payment. Digital B2B payments create a parallel pool of sales and transactions data, which can be leveraged to offer

POS-based financing solutions. Automated risk assessment drives credit decisions based on real-time access to transactional data available across the value chain (banks, payment intermediaries, AR-AP systems (ERP)):

-

Invoices of merchants, both raised and due (B2B) and their supply chain

-

Cash-flow position in integrated accounts

-

Retail sales

-

In-process payment settlements

-

History and status of credit availed, including repayments and defaults

-

Performance of merchant products and/or services and their distribution

For example, AMEX recently launched a digital B2B payments ecosystem platform or marketplace called Business LinkTM, where network issuing and acquiring participants can offer B2B credit solutions to their buyers and suppliers. Also, Visa Direct’s feature

for SMB Payouts enables real-time settlement of funds for small and medium businesses.

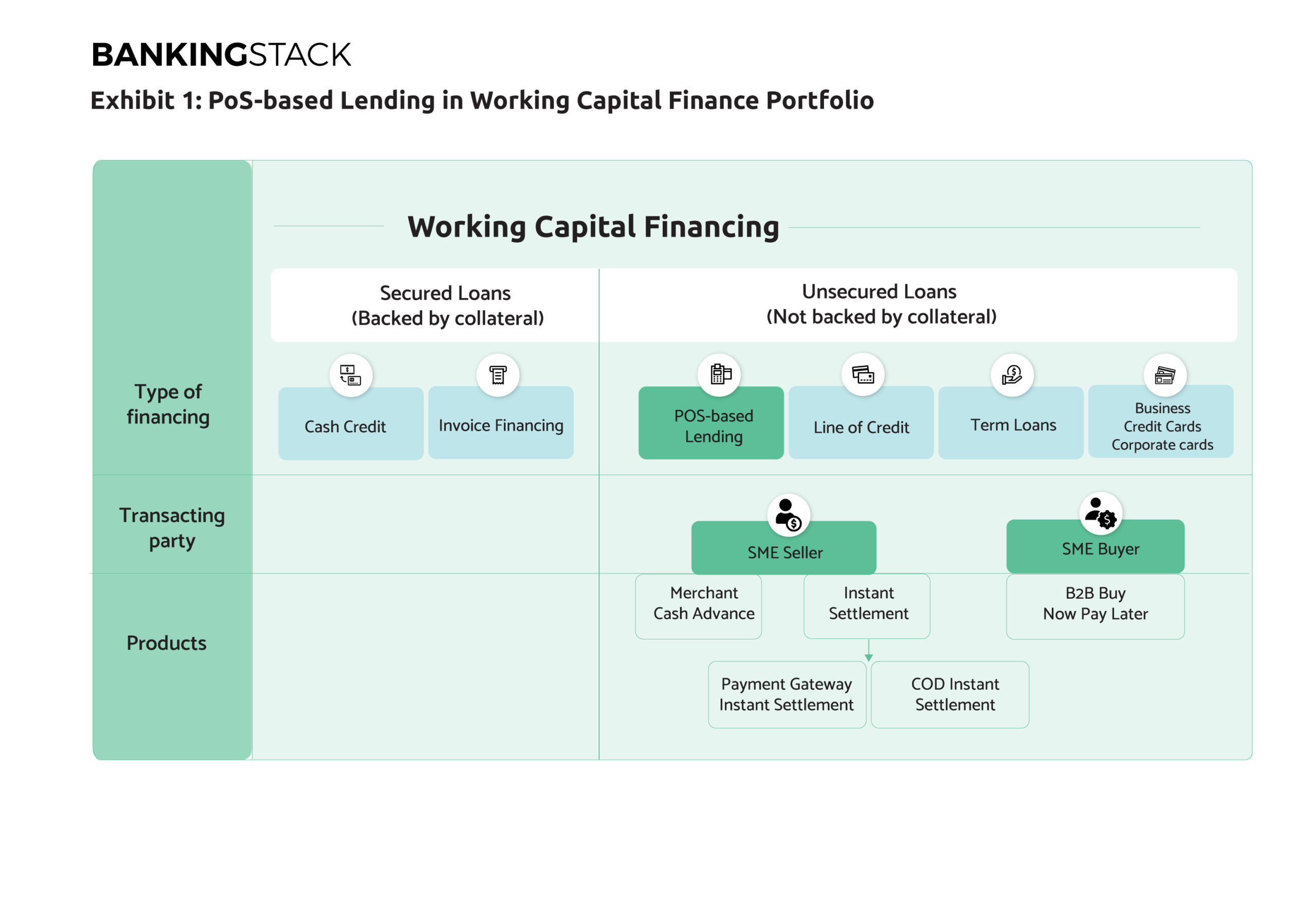

From a bank’s perspective, B2B POS-based lending would be a part of their working capital credit portfolio, aligned with other unsecured forms of lending (Exhibit 1). The lending products can be classified based on whether the borrower is the buyer or the

seller.

Use Cases

1. Payment Gateway Instant Settlement (PGIS)

Payment settlement cycles for digital transactions range from 2 to 7 days, depending on the mode of payment. With an increase in digital transactions, an increasing share of merchants’ capital is caught in transit. A Deloitte study found that SMEs may keep

between 4–7% of their annual sales as cash contingency to cover for the time it takes business payments to reach their accounts. Instant settlement provides easy and early access to money, helping SMEs improve their ability to take more orders, pay vendors

or utility bills/salaries, and save additional interest to creditors.

Today, most payment intermediaries (aggregators, gateways, processors and merchant platforms) offer instant settlement to merchants instead of regular batch settlement of ‘T + n’ days. In most cases, financing or credit is provided by a partner non-banking

financial institution.

Banks have greater direct visibility into the transactional footprint as the intermediary nodal account and SME current account can sit with them. They are thus well-positioned to offer PoS-based credit as instant settlement directly to their SME customers.

Some characteristics of PGIS:

-

Current PGIS offerings in the market allow merchants to choose from three frequencies for settlement: real-time, same-day or on-demand

-

The return on PGIS is set at a nominal fee, usually an additional charge of 0.2% to 0.8% on top of MDR, which is deducted from merchant’s settlement balance.

-

Refunds and chargebacks are handled via separate virtual accounts, where merchants are expected to keep reserve funds themselves.

-

Merchants can choose between several options for receiving settlement funds. In India, for example, Bank Account, Virtual Account Number, native wallets and Virtual Payment Address (UPI) are offered as settlement destinations by payment gateway providers

and IMPS, UPI, NEFT or RTGS as money transfer rails. This offers lenders low-risk exposure as it gives complete visibility to merchant transactions, payment gateway data and reconciliation cycle.

2. Cash on Delivery Instant Settlement (CODIS)

The Cash on Delivery payment mode is the most challenging one for merchants. At the same time, in several markets like India, COD is a preferred mode of payment for more than 65% of buyers. This is especially true of Direct-to-Consumer (D2C) brands, which

need to establish trust with customers and hence need to offer COD as an option.

The delivery cycle adds an additional data and money loop in the case of COD. Since delivery partners and logistics service providers aren’t regulated for payment settlement timelines, there is usually a delay of 7-10 days in depositing collected payment

in logistics provider or e-commerce provider account.

Given the longer working capital lock-in, instant settlement for CoD payments is a hot need for merchants. In terms of execution, the transaction data for CoD transactions stays available with the payment service provider as the transaction is initiated

on its platform. Status of collected payments is also reconciled with payment platforms and online settlement cycle is well known. This data can be utilised to assess the transaction-based financing eligibility of the merchant and short-term line of credit.

3. B2B Buy Now Pay Later (BNPL)

Embedded within the payments experience, B2B BNPL is collateral-free, short-term credit, which allows sellers to access payments immediately, while allowing buyers to improve their inventory turnover ratios. Driven by automated credit decisioning and embedded

experience, the B2B BNPL opportunity is currently owned entirely by fintechs. The B2B BNPL opportunity is being driven by the USD 25.65 trillion global B2B e-commerce segment (2028 expected size).

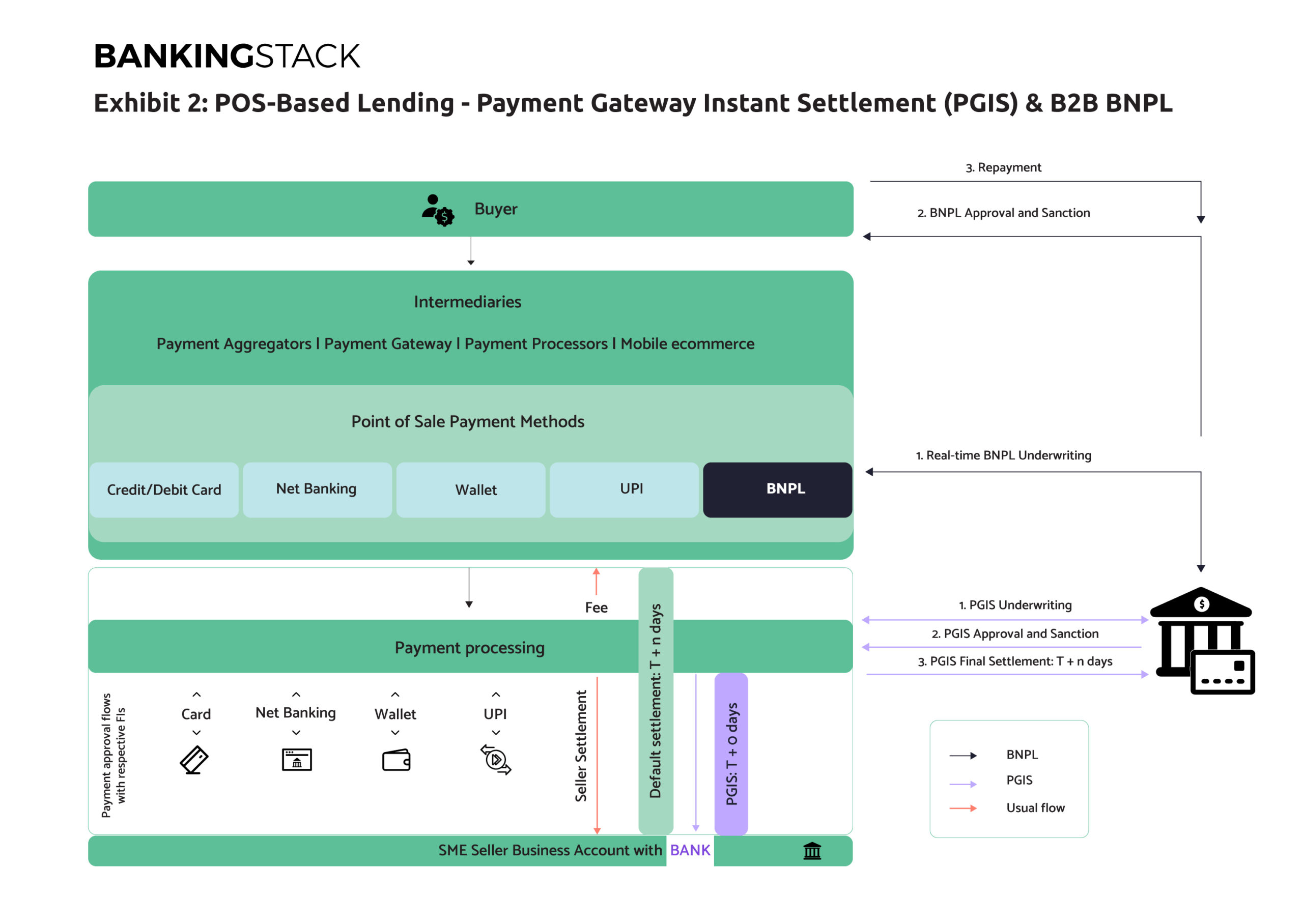

Exhibit 2 presents a workflow illustrating how PGIS and B2B BNPL would work with a bank functioning as the lender.

The Business Case for Banks to Adopt B2B POS-based Lending

With traditional risk assessment, less than 50% of business spends of SMEs are eligible for financing. The shift from asset-backed financing to cash flow or transaction-based financing is helping unlock the underserved SME lending market. While banks are

increasingly part of this shift through distribution partnerships with fintechs, the potential to own and monetise the merchant relationship is very limited. As of last year, fintechs have managed to pull away annual revenues worth USD 8 to 10 billion from

traditional lenders, and control about 10-15% of the supply chain finance (SCF) market.

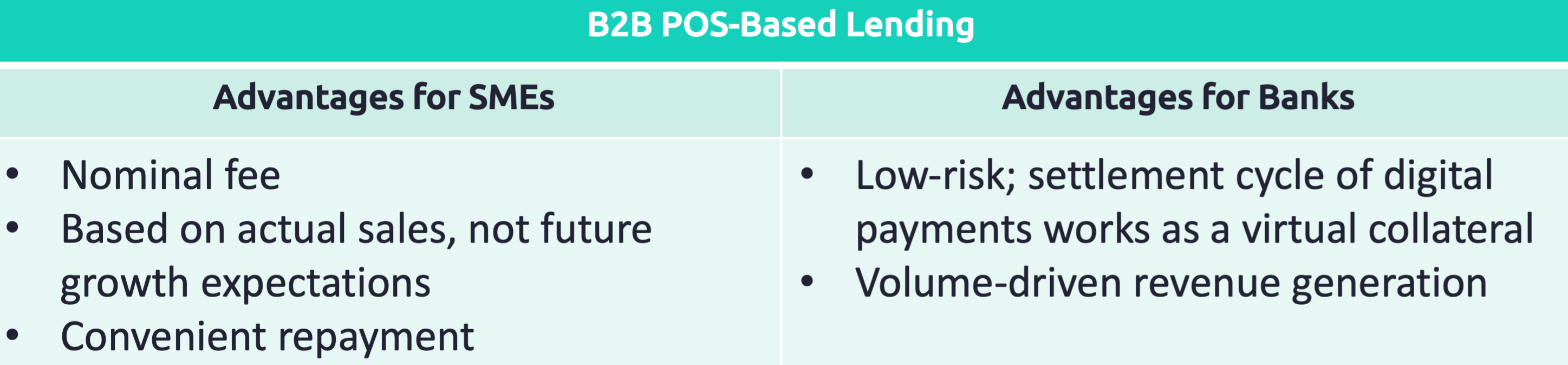

PoS-based lending is emerging as a liquidity management tool for SMEs, and is beneficial for both, SMEs and lenders.

Capability Layer

Compared to the more traditional forms of lending, B2B POS-based lending allows banks to scale lending to new to credit or new to bank SMEs cost-effectively, while controlling risk exposure. Let’s look at the capability set banks need to be able to deliver

this form of credit to their business banking customers:

-

Digital Onboarding: SMEs onboarded through digital-only channels, with minimal to no documentation requirements. Automated data validation within 24 hours or less through APIs with the business’ finance and accounting, ERP (AP/AR), e-commerce and digital

marketing tools.

-

B2B Checkout Experience: A multi-modal payment gateway embedded seamlessly in the merchant’s order-to-cash flow. Hosting the merchant’s entire business finance management experience within the native banking channel is the best model to ensure seamless,

cost-effective and real-time delivery of POS-based lending.

-

Credit Decisioning: Automated risk assessment using direct access to business data like aggregated balances, sales, purchase orders, inventory, receivables, payables, payment history, order delivery status, etc. Credit scoring capabilities based on alternate

data with enhanced fraud and risk assessment engines. Partnerships with data aggregators and account information service providers across credit history, tax returns, utility payments, etc.

- Delivery and Repayment: Automated workflows to calculate and deliver settlement amounts net of interest/fee. Flexible repayment options like booked sales, near future payments, or zero interest EMI schemes. Banks should also look at potential to control

where the spend happens by way of offering APIs to SMEs to build micro-transactions, wish-lists and shopping carts.

Adoption Strategies

Banks are already participating in the POS-based lending market through distribution strategies with payment service providers or merchant platforms functioning as channels to originate loans. While this has helped banks enter the market with minimal investments,

their access to the SMEs is limited and indirect.

The other approaches involve ‘building’ or ‘buying’ technology platforms with payments and POS-financing capabilities. Either of these approaches can help banks enhance engagement and monetisation of their existing business banking relationships, while presenting

a competitive value proposition for new-to-bank SMEs. Agility of adoption, ease of integration with existing infrastructure and workflows, and capex emerge as some of the critical decision-points for banks when making this decision.

Cloud-native SaaS platforms are emerging as an alternative to on-premise infrastructure-led technology solutions. Integrated financial management systems with a multi-modal payments experience built-in, can enable merchants to accept payments across modes

like net banking, credit/debit cards and UPI. With pre-built alternative underwriting capabilities embedded within these financial flows, banks can offer the right credit offering to the right business at the right time.

References:

1. Goldman Sachs; B2B: How the next payments frontier will unleash small business;

https://www.gspublishing.com/content/research/en/reports/2019/09/04/201b4777-6217-4638-9701-fb98d67d9d5d.pdf

2. https://www.globenewswire.com/en/news-release/2022/04/25/2428250/0/en/Global-Commercial-Lending-Market-Anticipated-to-Generate-a-Revenue-of-27-406-6-Billion-and-Rise-at-a-CAGR-of-14-4-during-the-Forecast-Timeframe-from-2021-to-2028-190-Pages-Reveals-.html

3. https://about.americanexpress.com/newsroom/press-releases/news-details/2022/American-Express-Launches-Amex-Business-Link-a-New-Digital-B2B-Payments-Ecosystem-for-Network-Participants/default.aspx

4. https://www2.deloitte.com/content/dam/Deloitte/uk/Documents/financial-services/deloitte-uk-economic-impact-of-real-time-payments-report-vocalink-mastercard-april-2019.pdf

5. https://www.mckinsey.com/~/media/mckinsey/industries/financial%20services/our%20insights/accelerating%20winds%20of%20change%20in%20global%20payments/chapter-3-supply-chain-finance-a-case-of-convergent-evolution.pdf

6. https://www.mckinsey.com/industries/financial-services/our-insights/buy-now-pay-later-five-business-models-to-compete

7. https://www.prove.com/blog/how-fintech-modernizes-sme-supply-chain